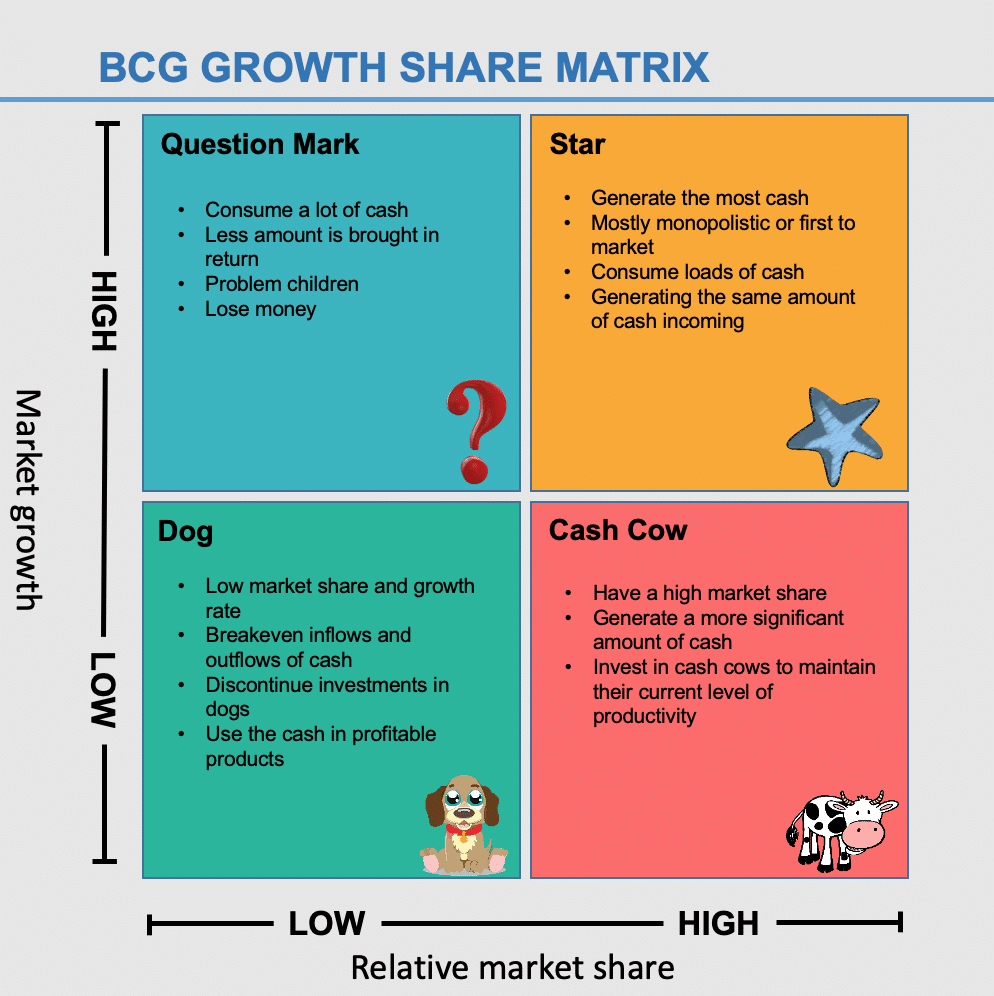

The goal is for Stars to become the next Cash Cows, where slowing industry growth coupled with a strong market positions and competitive barriers brings continuing high cash inflows and a decrease in cash demands. The business likely is generating a lot of cash because of its strong market share, but also has high cash needs to support growth. Stars are high potential businesses – with a high market share in a fast-growing industry. Let’s take a closer look at the characteristics of each of the quadrants. The positions within the matrix diagram and the dynamics around the business closely parallel the life cycle stages of business development.

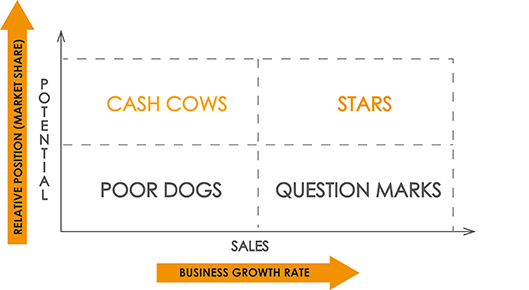

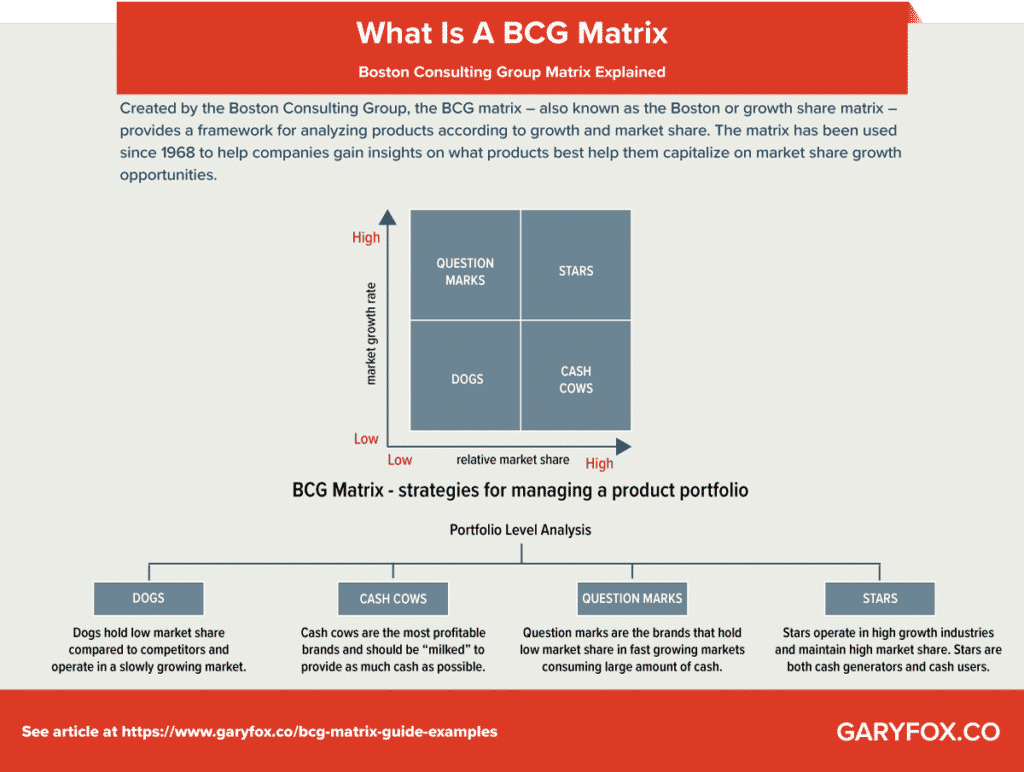

The strategic posture of the business is reflected not only by the quadrant, but where in the quadrant it sits. The idea is to place a particular business – the business your projects or programs are supporting – into one of these quadrants based upon Industry Growth and Relative Market Share. The Dog, at lower right, sits at the intersection of low Industry Growth and low Relative Market Share.At lower left, the Cash Cow is at the intersection of low Industry Growth and high Relative Market Share.The Question Mark – upper right quadrant – sits where high Industry Growth and low Relative Market Share intersect.The upper left quadrant, the Star, sits at the intersection of high Industry Growth and high Relative Market Share.Industry Growth provides a metric that reflects industry attractiveness, while Relative Market share reflects competitive advantage. The horizontal axis shows Market Share relative to the industry leader – from high on the left to low on the right. The Vertical axis reflects Industry Growth metrics – from low at the bottom to high at the top. The BCG Growth Share Matrix diagram consists of four quadrants with vertical and horizontal axes. Overview of the BCG Growth Share Matrix Diagram Let’s begin examining why it is relevant, and how it can help you manage your projects more effectively.

While the BCG Growth Share Matrix framework was developed decades ago, it still remains relevant today. The framework is very business/product/service oriented, so if your project is in a business that fits that broad profile, or an organization that deals with businesses that fit, this post will be of interest to you. As the name implies, the Growth Share Matrix allows you to visualize a product or service business related to the growth characteristics of the market and the market share related to competitors. This post examines the Boston Consulting Group Growth Share Matrix – developed by Bruce Henderson of the Boston Consulting Group (BCG) back in the early 1970s – and how it might relate to your projects.

0 kommentar(er)

0 kommentar(er)